Seed Round in Startup Funding

Founders/Startups

Explore what a seed round in startup funding is, how it works, and why it matters for early-stage businesses.

Introduction to Seed Round in Startup Funding

When you start a new business, getting the right funding early on is crucial. The seed round is often the first official money a startup raises to grow its idea. It helps founders turn their vision into reality by providing the initial capital needed.

Understanding the seed round can help you prepare better if you are planning to launch a startup or invest in one. This article explains what a seed round is, how it works, and why it is important for startups.

What Is a Seed Round?

A seed round is the first round of funding a startup raises from investors. It usually happens after the founders have developed a basic product or idea but need money to build it further. This round helps startups cover early expenses like product development, marketing, and hiring.

Seed rounds are typically smaller than later funding rounds, often ranging from tens of thousands to a few million dollars. Investors in seed rounds can include angel investors, early-stage venture capital firms, or even friends and family.

- Provides initial capital for product development

- Helps validate the business idea

- Supports early team building and marketing

- Usually involves convertible notes or equity shares

How Does a Seed Round Work?

Raising a seed round involves several steps. First, founders prepare a clear business plan and pitch to attract investors. They explain their idea, market potential, and how the funds will be used. Investors then decide if they want to support the startup.

Once investors agree, the startup and investors sign agreements outlining the terms. These terms often include how much equity investors get or if the investment is a convertible note, which converts to equity later.

- Prepare a pitch deck explaining your startup

- Identify and approach potential investors

- Negotiate terms and valuation

- Sign legal agreements and receive funds

Why Is the Seed Round Important?

The seed round is vital because it sets the foundation for a startup’s growth. Without this early funding, many startups struggle to develop their product or reach customers. It also helps attract future investors by showing that others believe in the business.

Moreover, the seed round allows founders to test their idea in the market. They can gather feedback, improve their product, and build a team. This early progress increases the chances of success in later funding rounds.

- Enables product development and market testing

- Builds credibility with future investors

- Helps form a strong founding team

- Validates the business model early on

Examples of Seed Round Success in No-Code Startups

No-code and low-code startups often rely on seed funding to launch quickly. For example, Bubble, a popular no-code app builder, raised seed capital to expand its platform and reach more users. Glide, another no-code tool, used seed funds to improve its user experience and add features.

These startups show how seed rounds can accelerate growth by providing resources to improve technology and marketing. Seed funding helps no-code companies compete and innovate in a fast-moving market.

- Bubble used seed funding to scale its no-code platform

- Glide improved its app builder with seed investments

- FlutterFlow raised seed capital to enhance its visual app development

- Zapier started with early funding to automate workflows

Tips for a Successful Seed Round

To succeed in a seed round, preparation is key. You need a clear plan and a strong pitch. Here are some tips to help you:

- Know your market: Show investors there is demand for your product.

- Build a prototype: A working model helps prove your idea.

- Choose the right investors: Look for those who bring experience and connections.

- Be transparent: Share realistic goals and challenges.

- Negotiate wisely: Understand terms to protect your ownership.

Conclusion

The seed round is a critical step in startup funding. It provides the early money needed to develop your product, test your market, and build your team. With the right approach, it can set your startup on a path to success.

Whether you are a founder or an investor, understanding the seed round helps you make better decisions. By preparing well and choosing the right partners, you can turn your startup idea into a thriving business.

FAQs

What is the main purpose of a seed round in startup funding?

Who typically invests in a seed round?

How much money is usually raised in a seed round?

What types of agreements are common in seed funding?

Why is the seed round important for no-code startups?

What are key tips for a successful seed round?

Related Terms

See our numbers

315+

entrepreneurs and businesses trust LowCode Agency

Investing in custom business software pays off

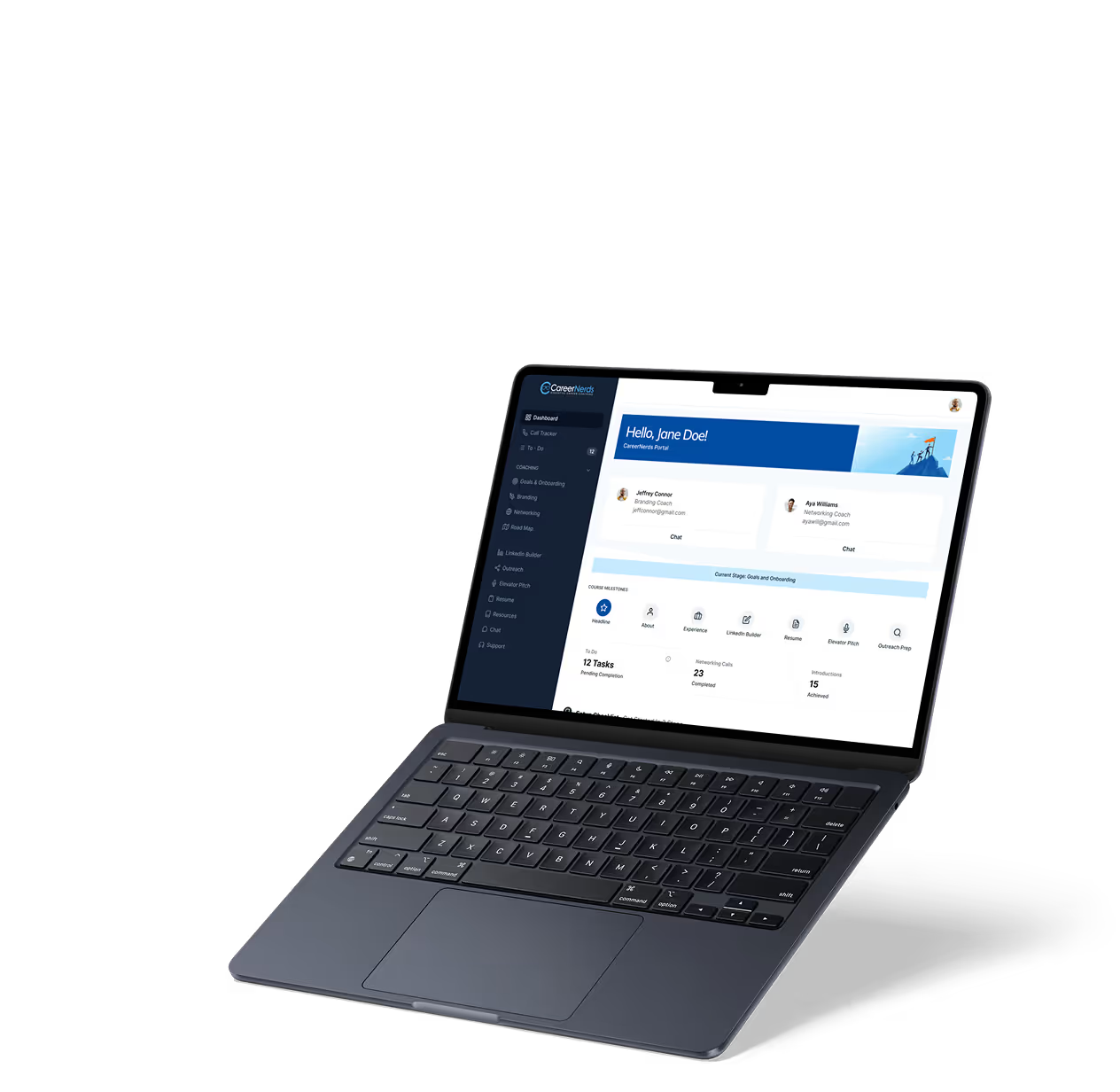

The team at LowCode Agency didn't just build an app, they transformed how we approach client management. They took the time to understand our methodology and created a solution that enhanced rather than replaced what made us successful.

75%

reduction in time spent on client management through automation

40%

increase in coach productivity within the first month

Tom Kent

,

Founder & CEO

Career Nerds

%20(Custom).avif)